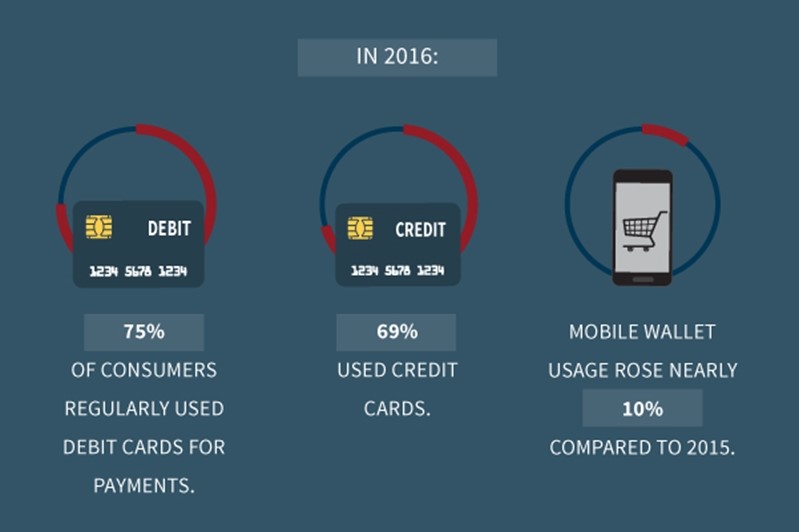

Technology has helped put consumers in the purchasing drivers’ seat, spending in more ways today than ever before. For example, while cash is still the most widely used payment method, bills and coins aren’t nearly as common today as they used to be, according to Blackhawk Network. In 2016, 75 percent of consumers regularly used debit cards for payments, 69 percent used credit, and mobile wallet usage rose nearly 10 percent compared to 2015.

It’s the variety of ways consumers spend money that makes the concept of integrated payments more relevant than ever for business owners.

As its name implies, integrated payments enables business owners – like retailers – to streamline the purchase process through automation, where multiple channels of processing are melded into one. This makes transactions easier to manage for business owners and enhances the customer experience.

But these value-added benefits are just the beginning. Integrated payments can yield serious dividends for business owners in a variety of industries.

1. Improves customer satisfaction and retention

With the economy back in gear, Americans are spending more money. In fact, according to a recent Gallup poll, the average consumer spends around $110 per day, the highest amount since 2008.

To keep consumers happy – and spending – high quality customer service is critical. Integrated payments solutions provide business owners with a database that can keep track of customer sales, the method in which buyers spend and other key metrics. Business owners can leverage these data points so customers can receive the type of assistance they both want and need. This can then lead to future sales opportunities, fueled by buyer loyalty.

2. Saves money

Customers aren’t the only ones who spend money during the transaction portion of the shopping process. Retailers do as well, in the forms of fees, equipment expenses and postage for paper-based payments. And this doesn’t include what business owners spend on wages for the employees who keep track of it all. Integrated payments solutions can yield significant savings through the power of automation. Managers can then devote their manpower to tasks that require a deft hand or facile mind.

3. Saves time

No one is perfect, a truism that business owners learn on a daily basis both in their own dealings and those of their employees. Whether it’s register drawers coming up short or improper data entry, errors take on a variety of forms when dealing with manual POS systems. But mistakes and flubs aren’t an issue with integrated payment processing implementation. The streamlined operations that integrated payments epitomize provide the reports, data entry and calculations that saves time, energy and resources.

4. Strengthens customers’ financial security

There’s no getting around the fact that identity theft is a major concern for consumers. Through a variety of circuitous methods, hackers attempt to steal highly sensitive financial details that can turn people’s lives upside-down. Last year, according to the Identity Theft Resource Center, business owners in the public and private sectors experienced nearly 1,100 data breaches, a 40 percent increase from the previous year, Bloomberg reported.

With an integrated payment processing platform in place, business owners can shore up their defenses through encryption and tokenization. Security experts say 33 percent of data breaches start at the POS system. Payment integration can stop these attempts dead in their tracks, providing added peace of mind to both customers and business owners.

5. Makes taxes less taxing

To ensure that all earned income is reported accurately to the IRS, business owners have to maintain a detailed paper trail, explaining their expenses, liabilities and assets. But with the world increasingly paperless, invoices and receipts can easily get lost and often are sent via email, where they can easily be overlooked. Payment integration simplifies the tax preparation process by compiling invoices, receipts and other transactions over a given year, expediting the tax preparation process and reducing stress.

Datacap serves as business owners’ payment integration headquarters. Regardless of the POS architecture, we can provide the payment solution services that help companies not only survive, but thrive.

Get started today!

Related Articles:

Featured

The stage is set for increased mobile payment adoption. Are your clients equipped to accept NFC payments?

Datacap has recently acquired the payments gateway technology asset from Octopi (formerly Monetary.co). As the new owner of the gateway and gift/loyalty platform, now referred to as NETePay Hosted, Datacap Systems is uniquely positioned as a provider of both in-store and hosted payment solutions…

Hosted Payments Services Providers give ISVs and VARs the technology tools and agility their clients need to do business in an omnichannel world.

Point of sale software delivered via the Software as a Service model gives SMB merchants a budget-friendly, low-risk way to have the POS functionality they need.

The right payments partner can give you and your clients the ability to engineer convenient, loyalty-building customer experiences on every channel.

Cash may be king, but it’s also very costly for businesses. Could integrated payments make sense for your business?

New processing solution from Datacap Systems and EVO Payments simplifies and accelerates EMV migration via ID TECH hardware

Datacap offers ISVs and VARs the opportunity to integrate PCI-validated P2PE and cross-platform tokenization with the point of sale and payment solutions they provide.

Merchants need to ensure consistent experiences as customers transition from e-commerce and mobile to in-store and unattended, especially if they begin their shopping journey on one channel and complete it on another.

POS ISVs and their VAR channels need to answer the persistent question: How do we compete? By analyzing the industry, talking with our partners, and considering the changes end users are facing in their markets, we are convinced the answer is value-added services.