What is Pay API?

Pay API is Datacap’s card-not-present payment API built around RESTful standards. These include standard HTTP methods (POST/GET/PUT), content types (JSON/XML/form encoded), and a resource-oriented architecture. It’s a straightforward integration to ecommerce credit, debit, and gift.

Compare Pay API Advantages at the Merchant Level

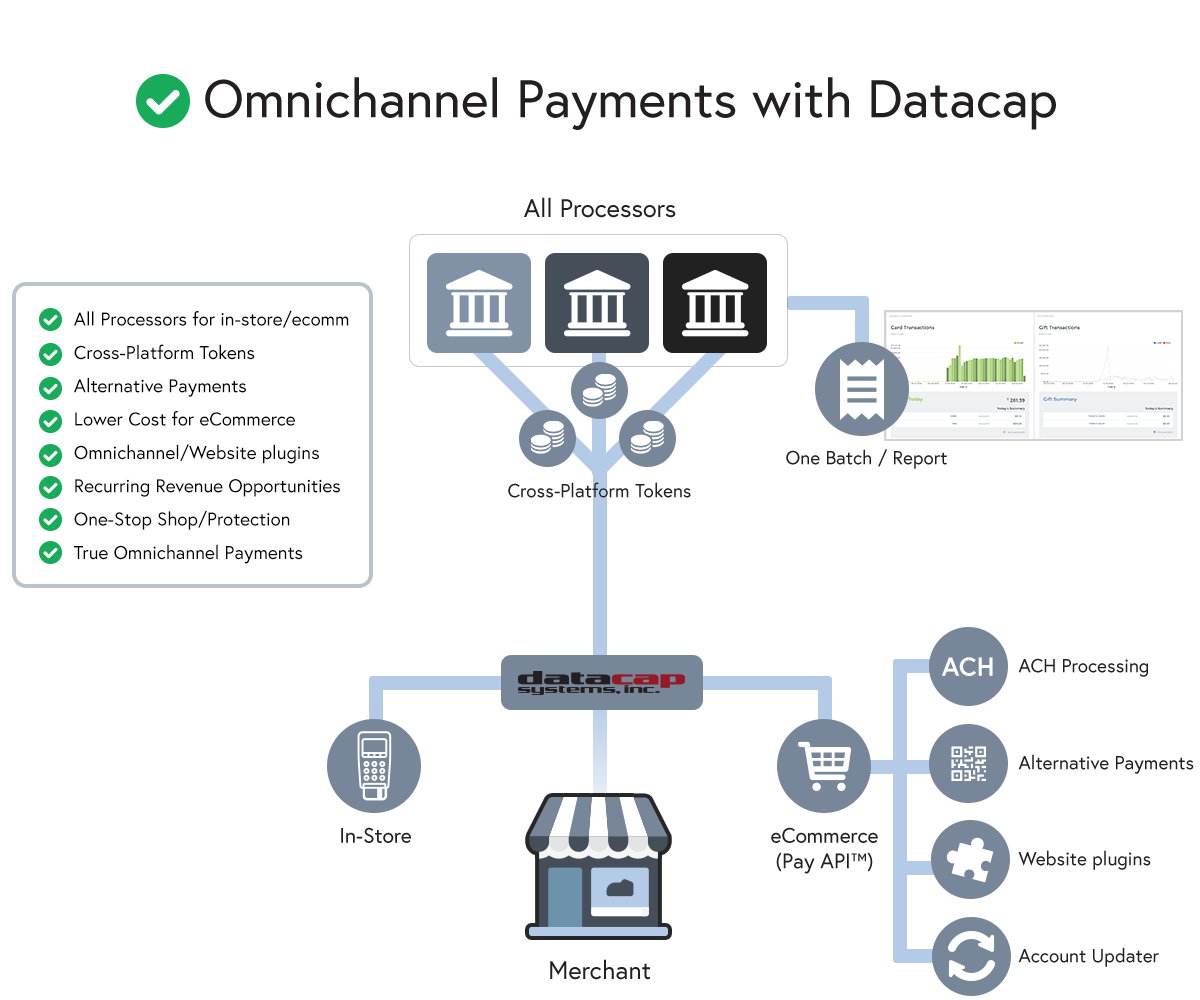

Click the arrows below to compare Omnichannel Payments with Datacap (using Pay API) vs. using Datacap for in-store payments and a 3rd party provider for eCommerce payments (not Omnichannel).

Why you should be using Pay API:

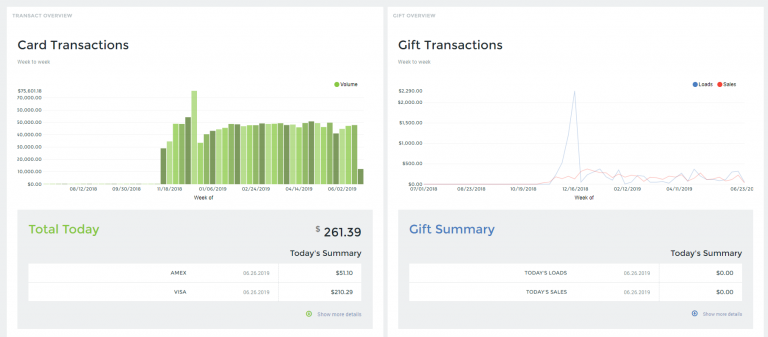

One Batch. One Set of Reports.

One batch. One set of reports. One merchant billing statement. One Payment Solution provider for in-store and above-store transactions.

Leverage the Same Processor for eCommerce and in-store

Datacap supports virtually all processors in North America for card-not-present and card-present payments.

Cross-Platform, Processor-Independent Tokens

By using Pay API, Datacap partners can take full advantage of cross-platform, processor-independent tokens. Datacap Tokens remain independent of specific payment processing platforms, so they are maintained as merchants change processing relationships. Tokens can originate online to use in store or vice versa.

Alternative Payments

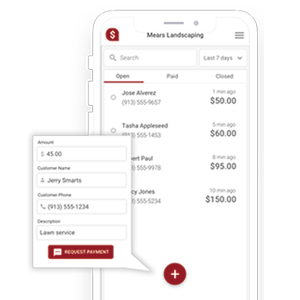

Datacap-ready alternative payment options from leading providers enable solutions like QR code payments, text-to-pay, online ordering, turn-key kiosks and more.

QR Code Payments

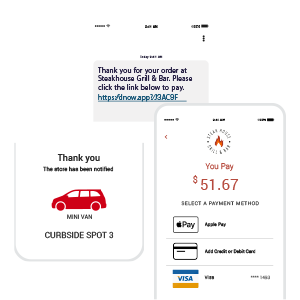

Text-to-Pay

Kiosks

Online Ordering

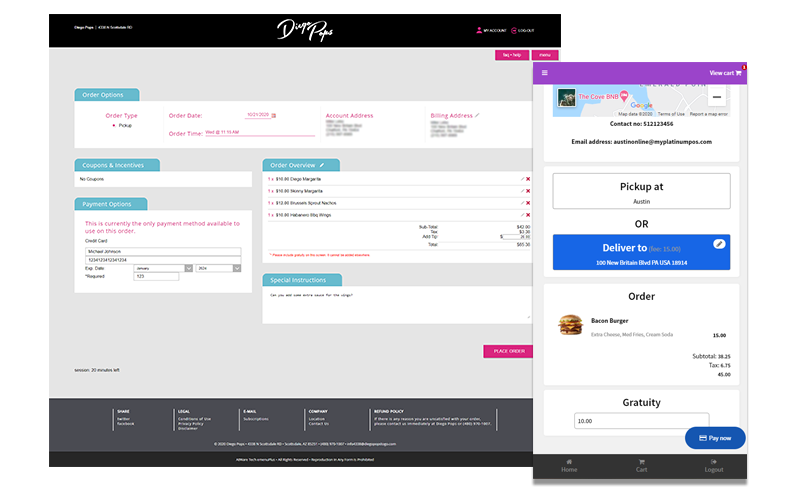

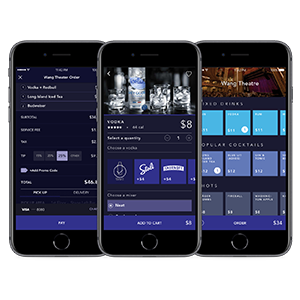

Online Ordering

Powered by:

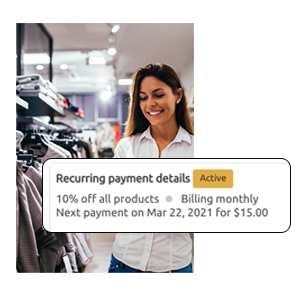

Memberships

TextPay

Lower cost to the merchant and Rev-Share opportunities for POS providers

Bundling in-store and ecomm payments with a single processor translates to a more aggressive price point for the merchant (interchange plus vs flat-rate) – saving them money. And, because all in-store and above-store transactions are running through the same processor, the pool of transactions contributing to POS provider rev-share programs grow with ecomm usage.

Omnichannel / Website plugins

Add plug and play eCommerce for your website with Pay API's website plugins.

ACH and Account Updater

With Pay API, Datacap partners add support for ACH processing and auto-account updater via tokens (coming soon) for soon-to-be expiring credit cards.

One-Stop Shop / Protection from "Free POS"

Being able to offer merchants a complete solution for card present and card-not present solutions protects Datacap partners from having to rely on 3rd Party eCommerce providers (that offer "free" POS or other POS competitive solutions). Adding support for Pay API allows Datacap partners to round out their own solutions, so they can become a one-stop shop for all things payments for their merchants.

True Omnichannel Payments

Today’s SMB merchants need an omnichannel payments platform (NETePay Hosted) to meet the expectations of new omnichannel shoppers. A single, integrated platform ensures that consumers have consistent experiences on all channels, even if they start their shopping journey on one and complete it on another. Pay API bridges the gap between in-store and eCommerce payments to enable a true omnichannel payments solution.